New Construction and Development

Mill Creek Residential, a leading developer, owner-operator and investment manager specializing in premier rental housing across the U.S., today announced it has broken ground on Modera South Shore Marshfield, a contemporary garden-style community boasting a charming seaside-town locale.

ST. AUGUSTINE, Fla. – St. Johns Housing Partnership (SJHP), a nonprofit that develops affordable housing, announced that Patriot Place has earned Gold Certification under the Florida Green Building Coalition (FGBC) Homes Standard.

The Calta Group, a real estate, development, and construction company led by Ignazio and Gaetano Caltagirone, has lifted the veil on Via Veneto, a highly-anticipated collection of 10 elegant townhomes.

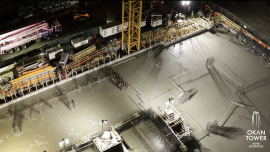

International property developer Okan Group, recently celebrated the foundation pour for their highly-anticipated development Okan Tower, set to be the area’s next major mixed-use megaplex. The 36-hour continuous pour began on Friday, March 29, and was orchestrated by general contractor Jacob Companies joint ventured with Okan Construction.

Inspired by Miami's original real estate visionary, Julia Tuttle, Neology’s latest residential tower to be completed in Allapattah is excited to welcome residents with nearly 35% of the units leased

Winmar Construction, an award-winning general contractor, has commenced the foundation pour for Coral Gables’ most highly anticipated and fashionable new address, The Avenue Hotel & Residences Coral Gables, today announced developer, Oscar Roger, Sr., President & CEO of Roger Development Group.

Housing Trust Group (HTG), a leading multifamily developer, has closed on financing and commenced construction on Naranja Grand II, a new $71 million affordable apartment community comprised of 200 residences in Southwest Miami-Dade County, Florida. A joint endeavor between HTG and Miami Lakes-based Elite Equity Development, Inc. (EED), Naranja Grand II is the second phase of a comprehensive two-phase development and addresses a critical need for affordable and workforce housing in Miami-Dade County. The first phase of Naranja Grand -- which caters to seniors aged 55 and older -- commenced construction in January on its 120 residences.

The Allen Morris Company, and its partner, the Alaska Permanent Fund Corporation, advised by L&B Realty Advisors, has closed on an $83 million construction loan and commenced construction on its signature Bayside Sarasota development. The loan was provided by Kennedy Wilson. Longboat Group will oversee leasing and management once complete.

172-unit Domus FLATS at Brickell Park represents debut of new condo-hotel brand