Trending Multifamily News

A report by Hoyt Advisory Services, Dinn Focused Marketing, Inc. and Whitegate Real Estate Advisors, LLC prepared for the National Multifamily Housing Council and the National Apartment Association was released. You can download the entire report here. Below is the executive summary:

The housing bubble fallout of 2007-2010 resulted in a paradigm shift in the U.S. among many households. Disillusioned by the bursting of the house price bubble that destroyed equity, many former home owners continue to rent today. Younger households, seeking more mobility and often saddled with student loans, postpone home ownership or choose to have the flexibility of renting. Demographic shifts also affect home ownership and the result has been a declining home ownership rate and corresponding increase in the percentage of households that rent. Some of this shift came about in the same housing units, as owned units became part of the rental inventory and today some one-third of all rental units are single-family units.

Tighter underwriting standards by lenders have resulted in a tighter supply of both multifamily and single-family housing with prices and rents exceeding the growth in income for the past decade. Housing affordability, especially on coastal markets, remains low.

Housing supply is adequate in most markets but there are many exceptions especially along the Northeast and Western U.S. coasts at certain price segments. Affordable market-based housing is only achievable with greater density and smaller sized units, yet land-use policies and political approval processes have moved in the opposite direction adding greater regulation and restrictions. The internet and social media have facilitated quick mobilization for groups that feel threatened by new housing developments that will add traffic and parking congestion in their neighborhood.

Demographic shifts, student debts and tighter underwriting continue to suggest substantial rental demand in the future. Among the major drivers of metro and state level household growth are in-migration policies and trends. As a whole, the U.S. depends on immigration to fuel the labor market. Any declines in immigration rates will severely curtail both the growth of the U.S. economy and future housing demand. In recent years, several metropolitan areas would have had zero or negative population growth were it not for international in-migration. Their natural population increases have been more than offset by domestic out migration and yet international migration has significantly supplemented the population. These metros include1 Chicago, Detroit, Milwaukee, Philadelphia, St. Louis and New York.

Among the metro markets studied, migration rates are a key telltale sign of the local economy’s direction. Those metros with strong economies also have significant population growth rates often derived from in-migration from both domestic and international sources. Examples include Houston, Charlotte, Austin and Tampa-St. Petersburg. Markets such as Washington D.C. and San Diego have strong international in-migration but experience domestic out-migration.

Uncertain in our housing outlook is the longevity of the current rental stock. This study assumes a base rate of economic obsolescence of 0.5% or 720,000 units per year on average through 2030. If the economic life of a housing unit is reduced to 100 years (1.0% per year), on average, then we need 1.4 million housing units per year just to replace the lost housing units. The type of housing needed in the future is also shifting towards units that accommodate older households.

Given the maturity of the current economic cycle, the forecast assumes that the U.S. economy could go through two recessions by the end of the forecast period in 2030. Even under this scenario, all 50 states and the 50 metropolitan markets in this study will need new multifamily housing going forward to meet a growing population base. The Southern states driven by economic growth, low costs and diversified demographic growth continue to lead demand forecasts with metropolitan markets in Texas and Florida ranked in 5 of the top 6 places. Phoenix, Atlanta, Raleigh and Las Vegas also rank in the top 10. Slower growth markets are more likely to experience new demand growth in specific neighborhoods. Developers and investors should evaluate these markets carefully for new growth as well as revitalization of existing neighborhoods. These markets are frequently located in the Midwest and Old South and include markets such as Cleveland, Milwaukee, Birmingham, Pittsburgh and New Orleans.

Growth drivers also vary greatly by metro market and will shape the format of new construction going forward. A few markets will continue to attract new renters of all ages, while many will experience an increasing proportion of demand from 35+ aged cohorts. The 65+ aged cohort will account for a large part of demand in some low growth markets, particularly those experiencing net out-migration trends. Income and ethnicity trends also vary significantly by market.

While some markets embrace growth, others are restricted either geographically and / or by policy. Supply-restricted markets tend to have higher rental costs and lower affordability. Markets with both high rental and high for-sale housing costs risk losing population bases to lower cost areas. The middle class, including necessary professions for a healthy economy such as teachers, police and fire-fighters, cannot afford average rents in these markets. States with healthy balance sheets and educated workforces continue to be primed to attract individuals and firms from these markets.

Several ‘known unkowns’ could occur going forward that would significantly change the forecast. At the national level, 75% of the variance in the U.S. home ownership rate since 1971 can be explained by policy changes such as those that impact capital and banking markets. It is unknown whether policy changes will be put into effect which could impact the applicability of the mortgage tax deductions, particularly for middle income families. Changes in these policies can affect the ‘own vs. rent’ decision and thus the amount of demand for multifamily properties going forward2 .

The second large ‘known unkown’ at the national level at the time of writing this report is the impact of policy changes on immigration rates. As the U.S. population ages, growth is slowing and becoming increasingly dependent on immigrants who have a higher tendency to rent. As a base case, population growth is expected to slow from 0.9% per year on average from 2000 to 2010 to 0.7% on average from 2016 through 2030. Under this scenario, immigration begins to outpace natural growth (births minus deaths) by 2023. Without immigration, population growth is expected to slow to 0.4% per year through 2030, less than half the pace of the past decade.

At the local level, some markets could surprise on the upside. For example, large tech campuses continue to expand in Seattle. A growing hub of large tech firms could attract more than expected small tech firms as well as individuals looking to escape the high costs of Silicon Valley. Detroit is at the other end of the growth spectrum but has been increasingly attracting a few investors who are aggregating large tracts of land.

The National Apartment Association announced a national grassroots campaign to advocate for a tax policy that promotes economic growth, job creation, and investment in neighborhoods and communities. “When Congress last overhauled the tax code in 1986 it had a negative ripple effect across our industry,” noted NAA President & CEO Robert Pinnegar, CAE. “We learned from that experience, and we want to make sure any changes to the tax code enable investment, minimize risk, encourage entrepreneurship, protect and create jobs and foster the development of affordable, livable communities. It should not unfairly burden apartment housing owners, operators and developers who pay taxes when they build, operate, sell or transfer communities.”

To learn more about the campaign, visit https://protectthelease.com

As we get closer to the National Apartment Association Education Conference and Expo, Kate Good joined the NAA team to share "Fast Fixes for Slow Markets". Register for the conference here: https://www.naahq.org/education-conference

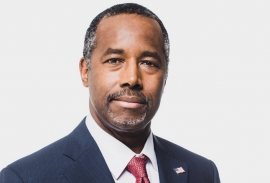

Statement from the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) following Dr. Ben Carson’s confirmation as the Secretary of the Department of Housing and Urban Development (HUD):

“NMHC and NAA congratulate Secretary Carson on his confirmation and as an industry, we look forward to working with him and his team to develop a balanced housing policy that recognizes the importance of a strong housing market for both rental and home ownership.

“President Trump’s recent comments before Congress and Secretary Carson’s confirmation are encouraging signs that the new administration is committed to working with the apartment industry to reduce burdensome regulations that create compliance uncertainty and result in costly mandates that divert resources from the production and operation of multifamily housing.

“With the number of households renting apartments standing at an all-time high of almost 19 million, it has never been more important that private industry and lawmakers come together in support of pro-growth policies that make it easier for American residents and families to find housing that fits their unique needs and circumstances and that helps them contribute to their communities. A modern, comprehensive housing policy will create millions of jobs and align housing supply with demand.”