Trending Multifamily News

Despite moderate improvements over the first quarter of 2017, all four indexes of the National Multifamily Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions remained below the breakeven level of 50. The Market Tightness (41), Sales Volume (30), Equity Financing (42), and Debt Financing (41) all indicated continued softening conditions in apartment markets even as demand for apartment residences remains strong.

“Although all four indexes rose in April, they remain below the breakeven level of 50,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “After years of lagging behind the increase in apartment demand, new supply is finally coming online in sufficient quantity to alter this supply-demand imbalance. In particular, class A supply in many urban core submarkets has led to increased concessions to fuel lease-up activity. Even so, occupancy rates remain close to historic highs.

“In the investment market, some of the weakness in property sales is seasonal, but respondents reported caution on the part of buyers as well as debt and equity capital sources – in particular in regard to construction lending. Increased uncertainty about the outlook for interest rates and cap rates also appears to be playing a role.”

The Market Tightness Index increased from 25 to 41, as one-fifth of respondents (20 percent) reported tighter conditions than three months ago, up from eight percent in January. Over one-third (38 percent) noted looser conditions. While this marks the sixth consecutive quarter of overall declining conditions, it does represent an uptick from the previous quarter.

The Sales Volume Index rose slightly, from 25 to 30. Half of respondents reported lower sales volumes from three months earlier, while 11 percent reported higher sales volume.

The Equity Financing Index rose from 33 to 42, marking the sixth quarter in a row below the breakeven level of 50. Over half (52 percent) of respondents reported unchanged equity financing availability from three months ago, while just over one-quarter (27 percent) of respondents considered financing less available. Twelve percent regarded financing as more available, up from six percent in January 2017.

The Debt Financing Index saw the largest increase of all four indexes, rising from 14 to 41, as respondents that reported worse conditions for borrowing compared to the three months prior fell to about one-third (35 percent) from almost three-quarters (74 percent). Forty-four percent of respondents reported no change in the debt market, with 16 percent reporting better conditions, up from only one percent in the previous quarter.

Respondents also noted little change in the Low Income Housing Tax Credit (LIHTC) market. Almost two-thirds of respondents (excluding those who chose “don’t know or not applicable”) reported either the same number or slightly more buyers for LIHTC transactions compared with three months ago. And 70 percent of respondents reported that pricing for LIHTC transactions has changed little since the 10-15 bps drop immediately following the Presidential election. About one-sixth (17 percent) reported somewhat higher pricing.

About the Survey:

The April 2017 Quarterly Survey of Apartment Market Conditions was conducted April 10-17, 2017; 140 CEOs and other senior executives of apartment-related firms nationwide responded.

View the full data online at nmhc.org/QS-April-2017

The apartment sector continued its record run, reflected in the National Multifamily Housing Council’s (NMHC) newly released 2017 NMHC 50 – the authoritative ranking of the nation’s largest apartment owners, manager, developers, general contractors, and, new this year, syndicators.

MAA (headquartered in Memphis, Tenn.) is the country’s largest apartment owner, with 99,393 apartment homes owned. Propelling MAA to the top of the list was its acquisition of Post Properties and its 24,000 apartments.

Greystar Real Estate Partners (headquartered in Charleston, S.C.) remained the largest apartment manager, with 415,634 apartments under management.

Greystar Real Estate Partners also jumped to the top of the apartment developers list this year through its 7,623 apartments started in 2016.

Alliance Residential Company (headquartered in Phoenix, Ariz.) retained its spot as the nation’s top general contractor for the second year in a row, starting 6,933 apartments in 2016.

Alden Torch Financial (headquartered in Denver, Colo.) is the country’s largest apartment syndicator with 183,456 apartments syndicated.

“Whether it’s rent growth, occupancy or absorptions, key industry metrics continued to show 2016 as one of the strongest years on record for the apartment industry,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Any way you slice it, last year was a tremendous one for multifamily.”

Additional industry and NMHC 50 highlights:

- 9.1 million – Growth in renter households over the past decade, according to the Census Bureau.

- 1,992,700 – Number of units owned in the NMHC 50 ownership list, representing 9.6 percent of the total apartment stock in the U.S.

- 3,177,852 – Number of units managed in the NMHC 50 management list, an all-time high and a 4.3 percent growth over last year.

- 96.2 percent – Occupancy rate in 2016, the highest since 2000, according to MPF Research.

- 311,700 – Number of apartments completed in 2016, according to the Census Bureau.

- 289,025 – Absorptions of apartments, which is 87 percent higher than historical average, according to MPF Research.

- $159.4 billion – Total transaction volume for 2016, a new record according to Real Capital Analytics.

NMHC partners with Kingsley Associates, a leading real estate research and consulting firm for the NMHC 50’s research and analysis. All apartment owners, managers, developers, general contractors and syndicators are invited to answer a survey questionnaire that asks about their prior year activities. Apartment owners, managers and syndicators are ranked based on their portfolio holdings (either owned or managed) as of January 1, 2017, while developers and general contractors are ranked based on the number of units started in 2016.

For more details about the NMHC 50, visit www.nmhc.org/The-NMHC-50

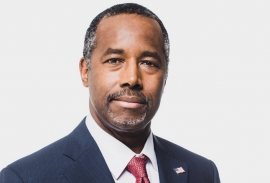

Statement from the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA) following Dr. Ben Carson’s confirmation as the Secretary of the Department of Housing and Urban Development (HUD):

“NMHC and NAA congratulate Secretary Carson on his confirmation and as an industry, we look forward to working with him and his team to develop a balanced housing policy that recognizes the importance of a strong housing market for both rental and home ownership.

“President Trump’s recent comments before Congress and Secretary Carson’s confirmation are encouraging signs that the new administration is committed to working with the apartment industry to reduce burdensome regulations that create compliance uncertainty and result in costly mandates that divert resources from the production and operation of multifamily housing.

“With the number of households renting apartments standing at an all-time high of almost 19 million, it has never been more important that private industry and lawmakers come together in support of pro-growth policies that make it easier for American residents and families to find housing that fits their unique needs and circumstances and that helps them contribute to their communities. A modern, comprehensive housing policy will create millions of jobs and align housing supply with demand.”

Apartment markets continued to retreat in the January National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. All four indexes of Market Tightness (25), Sales Volume (25), Equity Financing (33) and Debt Financing (14) remained below the breakeven level of 50 for the second quarter in a row.

“Weaker conditions are evident across all sectors as the apartment industry adjusts to changing conditions,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Rising supply—particularly during a seasonally weak quarter—is causing rent growth to moderate in many markets. At the same time, the sharp rise in interest rates in recent months was a triple whammy for the industry. First, higher rates directly worsen debt financing conditions. Second, the associated rise in cap rates also put a crimp in sales of apartment properties. Third, higher cap rates following the long run-up in apartment prices caused greater caution among equity investors.”

“The underlying demand for apartment residences remains strong, however. While new apartments continue to come online at a good clip, absorptions of those apartments remain strong. As long as the job market continues its steady expansion, any local supply overshoots should be manageable,” said Obrinsky.

The Market Tightness Index dropped three points to 25 – the fifth consecutive quarter of declining conditions and the lowest in more than seven years. Over half (58 percent) reported looser conditions from three months ago, compared to only eight percent who reported tighter conditions.

The Sales Volume Index fell from 42 to 25, signifying lower overall sales volume for the second quarter in a row. Just five percent reported higher sales than three months prior, compared to 55 percent that reported lower sales.

The Equity Financing Index remained unchanged at 33. This marks the fifth consecutive quarter of declining conditions. Like the other indexes only a small fraction (six percent) indicated improved conditions compared to the previous three months. Conversely, four in ten reported less equinity financing available over the same period.

The Debt Financing Index declined 24 points to 14. Almost three quarters (74 percent) reported worse borrowing conditions compared to the three months prior. Just one percent reported improved conditions. This marks the lowest index level for the series since October 2008.

About the Survey:

The January 2017 Quarterly Survey of Apartment Market Conditions was conducted January 10-17, 2017; 148 CEOs and other senior executives of apartment-related firms nationwide responded.

View the full data online at nmhc.org/QS-January-2017

The National Multifamily Housing Council (NMHC), which represents the leadership of the $1.3 trillion apartment industry, has chosen Shelters to Shutters as their designated beneficiary charity for 2017. Shelters to Shutters (S2S) is a national 501(c)3 organization that transitions individuals and families from homelessness to economic self-sufficiency by educating and engaging the real estate industry to provide employment and housing opportunities. NMHC and its members have raised more than $1.3 million for charities since 2012.

"Shelters to Shutters is a non-profit tied directly to the multifamily industry and we’re thrilled to be able to support their work," said NMHC President and CEO, Doug Bibby. “Not only are they giving a new beginning and pathway to economic self-sufficiency for deserving individuals, they are providing our industry with quality, motivated and loyal employees.”

NMHC is encouraging its members to join in the fight to end homelessness and participate in the NMHC Walk/Run to Benefit the Homeless taking place at the 2017 NMHC Annual Meeting on January 26, 2017. The walk/run will take place at the Manchester Grand Hyatt beginning at 7:00 AM and will raise awareness and financial support for S2S.

Founded in 2014 by a multifamily executive, Shelters to Shutters is currently operating in 11 cities with 13 property management partners including AvalonBay Communities, Crescent Communities, Equity Residential, Freeman Webb, Drucker & Falk, Middleburg and Waterton among others. S2S assists veterans, domestic violence survivors and other deserving individuals who are ready-to-work and excited for a career in property management.

Those who wish to donate can visit https://shelterstoshutters.rallybound.org/nmhc/Donate

Apartment markets softened across all four indexes in the October 2016 National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. The Market Tightness (28), Sales Volume (42), Equity Financing (33) and Debt Financing (38) Indexes all landed below the breakeven level of 50 – showing weaker conditions from the previous quarter.

“The growing supply of new apartments, primarily in the Class A space, appears to have finally reached a level to slow the historically high rent growth. Additionally, debt and equity markets are more discerning in terms of what deals they are ready to take on, including the continued slowing of available construction loans,” said Mark Obrinsky, NMHC’s Senior Vice President of Research and Chief Economist. “Despite the softening due to the new development focus on Class A apartments, the overall fundamentals for apartments remain stable, indicated by the strong demand for Class B and C properties.”

The Market Tightness Index fell to 28, the lowest since July 2009 and the fourth quarter in a row showing declining conditions. Almost half of respondents (49 percent) reported looser conditions than three months ago. Likewise, only six percent noted tighter conditions. The remaining 45 percent reported no change at all.

The Sales Volume Index decreased from 50 to 42, signifying lower overall sales volume. Sixteen percent of respondents reported higher sales than three months prior, compared to 33 percent that reported lower sales volumes.

The Equity Financing Index dropped 11 points to 33. This marks the fourth quarter in a row below 50 and the lowest in more than seven years. Forty-two percent of respondents believed that financing was less available, compared to eight percent who regarded financing as more available.

The Debt Financing Index decreased from 62 to 38, indicating a sharp reversal from last quarter. One-third of respondents reported worse conditions for borrowing compared to the three months prior, while only nine percent reported better conditions. Over half (52 percent) reported no change whatsoever in the debt market.

The survey also asked about rent growth among different class buildings. Excluding the ten percent that marked “don’t know/ not applicable”, nearly nine of ten (84 percent) respondents reported rent growth for Class B and C apartments as much stronger (33 percent) or somewhat stronger (51 percent) rent growth compared to Class A units. Just five percent reported somewhat weaker rent growth among Class B and C apartments compared to Class A, and two percent thought that B and C apartments exhibited much weaker rent growth. The remaining nine percent reported that rent growth levels were about the same throughout all classes of apartments.