Trending Multifamily News

CHICAGO – JLL announced today that it has arranged $17.345 million in financing for Iron Gate, a 180-unit fractured apartment and condominium community in the western Chicago suburb of Glen Ellyn, Illinois.

JLL worked on behalf of the borrower, Bear Peak Capital, LLC, to arrange the three-year, floating-rate loan through Bridge Debt Strategies. Loan proceeds will be used to convert the remaining 50 condominiums into conventional multi-housing units. The conversion process will also include various exterior and interior improvements.

Iron Gate is situated on 8.6 acres at 11 Briar Street near Metra’s Union Pacific West commuter rail line and IL-38, both of which provide direct access to downtown Chicago. The property consists of five two-story buildings with homes averaging 721 square feet along with 222 parking spaces. Community amenities include a swimming pool, playground, on-site laundry facilities and high-speed internet access. The property was 96% occupied at closing.

The JLL Capital Markets team representing the borrower was led by Managing Directors Jason Bond and Trent Niederberger.

ATLANTA – JLL announced today that it has closed the sale of Alpharetta City Center, a unique heritage-based, mixed-use residential and retail property in downtown Alpharetta, Georgia.

JLL marketed the asset exclusively on behalf of the sellers, South City Partners and Morris & Fellows. CBRE Global Investors purchased the property on behalf of a separate account client.

Alpharetta City Center consists of 82,700 square feet of high-end boutiques and chef-driven restaurants and 168 elite residences finished to bespoke quality within a multi-housing community called Amorance. The property is adjacent to Alpharetta City Hall, the Fulton County Library, Brook Street Park and Town Green, and is the trailhead of the new Alpha Loop trail system. Designed to blend with the historical architecture in downtown Alpharetta, the project contains three components.

Amorance, developed by a partnership of South City Partners and Morris & Fellows, is a two-building luxury community with a mix of one- and two-bedroom floor plans, averaging 1,067 square feet. Completed in 2018, the property features a penthouse-level clubroom with outdoor patio, catering kitchen and communal living room with fireplace and TV; pool courtyard with grilling area, fire pit and lounge seating areas; and expansive fitness center with yoga and spin rooms.

The District, a 41,650-square-foot collection of local boutiques and luxury service providers sits at street level below the apartments.

The Gardens, developed by Morris & Fellows, houses 41,050 square feet of chef-driven restaurants in two and a half acres of parks and green spaces spanning three city blocks of Main Street. The retail and restaurants are 100% leased.

The JLL Capital Markets team representing the seller was led by Managing Directors David Gutting, Margaret Caldwell (now with Arden Capital Advisors) and Derrick Bloom and Vice President Margaret Jones.

“Alpharetta City Center was a unique opportunity for an investor to own the impossible – an irreplaceable slice of Downtown Alpharetta that will continue to appreciate dramatically throughout CBRE Global Investors’ ownership,” Gutting said.

“As we anticipated, Alpharetta City Center received significant interest from institutional investors,” Caldwell added. “This is the type of trophy asset that most investors want in their portfolio due to the location, high-end residential, boutique retailers and local restaurants.”

DENVER – JLL announced today that it has arranged $16 million in financing for The Park at Sunderland, a 268-unit, garden-style apartment community in Birmingham, Alabama.

JLL worked on behalf of Vazza Real Estate Group to originate the fixed-rate Fannie Mae acquisition loan. The 12-year loan includes five years of interest-only payments followed by a 30-year amortization schedule. Jones Lang LaSalle Multifamily, LLC, a Fannie Mae DUS lender, will service the loan.

The Park at Sunderland is located at 660 Valley Crest Drive less than 10 miles from downtown and a two-minute drive to major employers in Northeast Birmingham, including Kamtek, Sterlite and several other transportation and manufacturing operations. The property, which underwent four years of extensive renovations that were completed earlier this year, features units averaging 951 square feet. Community amenities include two swimming pools, a tennis court, playground, picnic area with grills, clubhouse, updated fitness center, business center, internet café, coffee bar and laundry center. The property was 92% occupied at closing. Vazza Real Estate Group plans to invest another $1.4 million of additional capital into the property post-close.

The JLL Capital Markets team representing the borrower was led by Senior Director Kristian Lichtenfels.

“This is our third sizable residential acquisition in the past six months,” said Stephen F. Vazza, President of Vazza Real Estate Group. “Given the favorable credit markets, we are taking a closer look at our inventory in smaller markets where the cap rates are more attractive and supply is limited.”

NEW YORK – JLL announced today that it has arranged $97.5 million in financing for the development of the second phase of Atlantic Station, a luxury mixed-use residential and retail property in downtown Stamford, Connecticut.

JLL worked exclusively on behalf of the developer, RXR Realty, to secure the floating-rate construction loan through Bank OZK. The development of the second phase of Atlantic Station follows the success of the first phase, which consists of 325 luxury rental units along with 321 on-site, structured parking spaces and 16,000 square feet of retail. The first phase was delivered in January 2018 and experienced strong leasing velocity due to heavy demand for luxury rental units in the area.

The 26-story second phase of the Atlantic Station project will consist of 325 condo-quality units, approximately 48,000 square feet of retail and a 534-space structured parking garage. The retail component is 100% pre-leased to three tenants: The Learning Experience, Work Well Win and Dogtopia. In addition to the sweeping views and brand-new construction, the amenity package for Phase II includes a 24-hour staffed lobby, a fitness center with floor-to-ceiling glass, resident lounge, outdoor landscaped deck and an elevated swimming pool deck. Units will feature nine-foot ceilings, balconies, hardwood floors, stainless steel appliances, stone countertops, and in-unit washers and dryers. Atlantic Station Phase I and Phase II are located at 355 Atlantic Street and 405 Atlantic Street, respectively. The development is within walking distance to the Stamford Transportation Center, which provides access to New York’s Grand Central Station within 45 minutes via the Metro-North Railroad as well as Amtrak and ConnDOT for connectivity to regional destinations such as New Haven, Boston, Washington, D.C. and New Jersey. In addition, the development is within a half mile of Interstate 95 and near a Harbor Trolley stop for local transportation. Completion is expected in 2021.

The JLL Capital Markets team representing RXR Realty included Executive Managing Director Mike Tepedino, Senior Managing Director Michael Gigliotti and Director Scott Findlay.

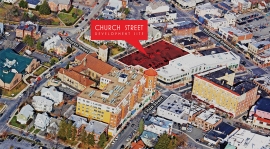

MORRISTOWN, N.J. – JLL announced today that it has closed the sale 65 Church Street, a 0.832-acre mixed-use residential development site in downtown Montclair, New Jersey.

JLL marketed the property exclusively on behalf of the seller, Kensington Senior Living, and procured the buyer, Bijou Properties.

65 Church Street is located near downtown Montclair’s sidewalk cafés, retailers and street performers within the Hahnes Redevelopment Zone. The transit-oriented, infill site has earned a Walk Score® of 95 and is proximate to the NJ Transit Bay Street Station. The main-and-main location provides the opportunity to construct a best-in-class, boutique mixed-use property with ground-floor retail and up to five stories of residential space above.

The JLL Capital Markets team representing the seller included Jose Cruz, Marc Duval, Stephen Simonelli, Kevin O’Hearn, Michael Oliver and Mark Mahasky.

“We had a great response to the offering given it is a multi-housing development in Montclair,” Cruz stated. “The investors were driven by the strong demographics in town.”

NEW YORK – JLL announced today that it has arranged $386 million in financing for 70 Pine Street, a 66-story, 1.03 million-square-foot, mixed-use, Art Deco-style tower in Lower Manhattan’s Financial District.

JLL worked on behalf of the borrower, a joint venture between DTH Capital and Rose Associates, to secure the five-year, floating-rate financing through Goldman Sachs. Loan proceeds refinanced construction financing that funded the redevelopment of the property.

70 Pine Street consists of 612 luxury rental apartment units, a 132-room Lyric Hotel and approximately 30,500 square feet of retail leased to Black Fox Coffee, Blue Park Kitchen and gourmet grocer City Acres. In addition, the property is home to two restaurant concepts by James Kent and Jeff Katz, formerly of Eleven Madison Park and Del Posto, including the critically acclaimed Crown Shy.

The iconic New York property, which formerly served as the global headquarters for CITGO and AIG, was originally constructed in 1932. Some of its most notable Art Deco architectural features were preserved through during its 2016 transformation into a state-of-the-art residential building. 70 Pine features three tiers of residential packages: the City, Tower and Penthouse Collections, all of which include conveniences such as high-quality appliances, stone countertops, European cabinets, in-unit washers and dryers and walk-in closets. Residential amenities include access to the 21,000-square-foot Elite by NYSC fitness center and a private bowling alley, screening room, golf simulators, children’s playroom, game room and lounge.

The JLL Capital Markets team representing the borrower was led by Managing Director Christopher Peck, Senior Director Geoff Goldstein and Associate Kristen Knapp.