Property Acquisitions and Dispositions

MORRISTOWN – JLL Capital Markets announced today that it has arranged the $18.625 million refinancing of 39 High Street, an 83-unit multi-housing community located in the Journal Square neighborhood of Jersey City, New Jersey.

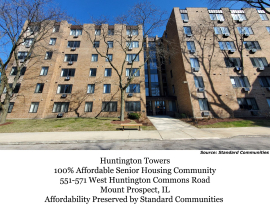

Standard Communities, a major national affordable housing developer and investor, has led a public-private partnership acquiring Huntington Towers, a 100% senior affordable 214-unit community in Mount Prospect, IL. The transaction extends and preserves affordability for 30 years.

Northcap Commercial, is pleased to announce that principals Robin Willett, Devin Lee, CCIM, and Jerad Roberts, based in the firm's Las Vegas office, finalized the $33.5 million sale ($173,575 per unit) of the Intrigue Apartments, consisting of 193 units built in 1986 located at 4600 Vegas Drive in Las Vegas, Nevada (Clark County).

Greystone, a leading national commercial real estate finance firm, provided a $23,484,000 Fannie Mae DUS® loan for the acquisition of a multifamily property comprising 200 units in Indianapolis, Indiana. The financing was originated by Avi Kozlowski, Managing Director at Greystone.

Eastham Capital’s investments and renovations led to a 40% increase in revenue during its ownership of the property

Joint venture completes successful disposition of newly built Eden West in Tamarac

The Mogharebi Group (TMG) has arranged the $13.6 million sale of Cedar Oaks Apartments, a 98-unit multifamily community in Bakersfield, CA. Senior Vice President Mark Bonas represented the seller in the off-market transaction. Both Buyer and Seller are local Central Valley investors. According to CoStar, this sale represents the 2nd largest transaction this year in Bakersfield.

“The Buyer is an experienced Central Valley investor who wanted to add to his holdings in Bakersfield,” said TMG’s Bonas. “The Buyer reached out to TMG with a requirement to acquire a property within a specific unit size and price range. Given our experience and relationships in the area, we were able to quickly identify a property whose owner might be ready to sell. We were able to go into escrow within days.”

The garden style community sits on a 1.76-acre site at 3300 Gosford Road. Built in 1984, the property is comprised entirely of two-bedroom apartment homes. Each unit features an all-electric kitchen, washer/dryer hookups, covered parking, and access to a community pool. It is surrounded by some of Bakersfield’s most affluent neighborhoods including Olde Stockdale and Seven Oaks at Grand Island. The property also attracts students from Cal State Bakersfield, which is only two miles away, helping the property consistently achieve high occupancy levels.

The property was 98.5% leased at closing.

As a leader in multifamily investment advisory since its founding in 2015, The Mogharebi Group has been especially active in the Central Valley—closing on more than 10,000 units in the region with total value exceeding $1 billion.

The Boot Ranch Apartments added to EPC Promecap Multifamily Partners V, LLC (“Fund V”) Portfolio